Table of Contents

ToggleHow to Trade the Evening Star Candlestick Pattern

The Evening Star Candlestick Pattern is a crucial tool in technical analysis for traders who aim to identify potential market reversals. It serves as a clear indication of when an uptrend is losing momentum and is about to turn into a downtrend. This makes it a prime opportunity for traders to either sell their positions or take a short position for profit. In this ultimate guide, we’ll explore how to recognize, analyze, and trade the Evening Star pattern effectively, with insights from Stockers Academy, the leading institute for stock market classroom coaching in Delhi.

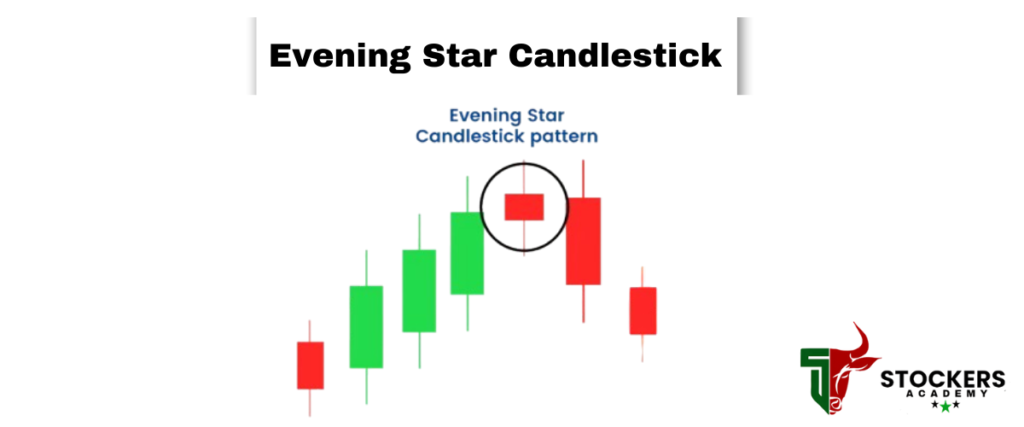

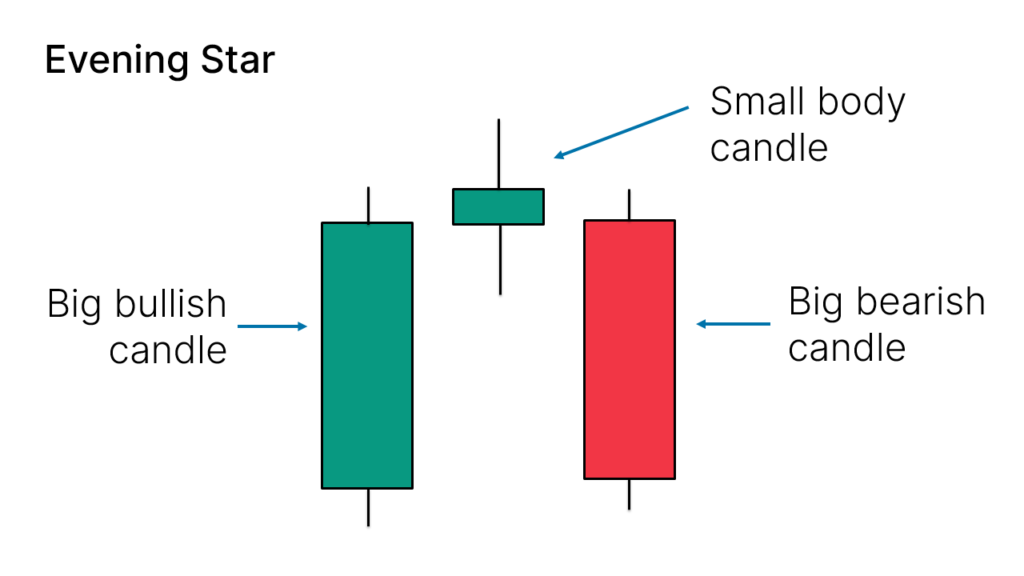

The Evening Star is a three-candle formation that appears at the top of an uptrend, signaling a potential market reversal. Understanding this pattern can greatly enhance your trading strategy. Here’s a breakdown of its components:

- First Candle: This is a large bullish (green) candle that indicates strong buying pressure. It shows that buyers are in control, pushing the price higher.

- Second Candle: The second candle is a small-bodied candle, often a doji. This candle represents market indecision, meaning buyers are starting to lose their grip. It can be either bullish or bearish, but its small size indicates a slowdown in momentum.

- Third Candle: The third candle is a strong bearish (red) candle that confirms the reversal. It closes well below the first candle, signaling that sellers have taken control of the market.

Recognizing the Evening Star pattern is essential for traders at Stockers Academy. We teach our students how to identify and trade this powerful pattern effectively, helping them make informed trading decisions. By understanding each candle’s role, you can position yourself better to capitalize on potential market reversals.

To effectively trade the Evening Star pattern, you must first learn how to identify it. Here are the key aspects to look for:

- Location: The Evening Star pattern should appear after a clear uptrend. This means you should see a series of bullish candles showing that the price has been rising consistently. Spotting this pattern at the top of an uptrend signals that a reversal may be on the horizon.

- Candle Characteristics:

- First Candle: The first candle should be significantly larger than the second. This large bullish (green) candle indicates strong buying pressure and shows that buyers are in control.

- Second Candle: The second candle will have a small body, which signifies market indecision. This small-bodied candle, often a doji, suggests that the buyers are starting to lose momentum. It can be either bullish or bearish.

- Third Candle: The third candle must be bearish (red) and close below the midpoint of the first candle. This strong bearish candle confirms the reversal, indicating that sellers have taken control of the market.

At Stockers Academy, we teach our students how to recognize the Evening Star pattern effectively. By understanding these key elements, you can improve your trading strategy and make better-informed decisions in the stock market.

The Evening Star pattern is an important signal for traders. It indicates that buyers are losing control and that sellers are starting to take over. This shift in momentum is crucial because it often leads to a decline in price.

When you see this pattern forming at the top of an uptrend, it provides traders with an excellent opportunity to enter short positions. Essentially, this means that traders can sell their positions or bet against the stock, expecting the price to drop further. Recognizing the Evening Star pattern allows you to act quickly and potentially profit from the market reversal.

At Stockers Academy, we emphasize the importance of understanding these market signals. Our courses provide you with the skills and knowledge needed to identify patterns like the Evening Star, enabling you to make more informed trading decisions. By mastering this pattern, you can enhance your trading strategy and increase your chances of success in the stock market

Trading the Evening Star involves several important steps to maximize your chances of success. Here’s a simple guide:

1. Entry Strategy

To enter a trade, wait for the third candle to confirm the reversal. This means you should enter a short position only after the bearish candle closes below the first candle. This confirmation gives you more confidence that the price will continue to drop.

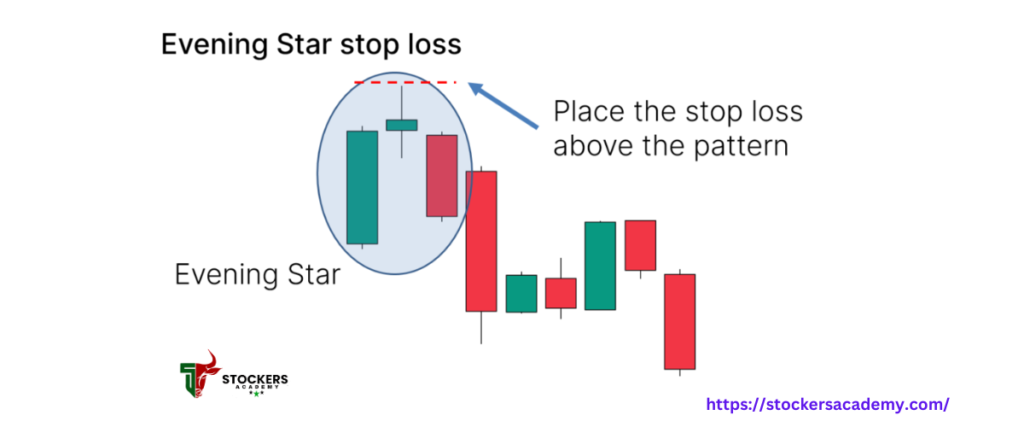

2. Stop-Loss Placement

To protect your capital, place your stop-loss order above the high of the second or first candle. This way, if the pattern fails and the price moves against you, your losses will be limited. Setting a stop-loss is essential for good risk management.

3. Take-Profit Targets

Set your profit targets based on key support levels or Fibonacci retracement levels. These indicators help you decide where to take your profits as the price moves in your favor. By having clear targets, you can secure your gains and avoid holding onto a position for too long.

At Stockers Academy, we teach our students these essential trading steps for the Evening Star pattern and other trading strategies. By following these guidelines, you can develop a solid trading plan and improve your overall performance in the stock market.

At Stockers Academy, we offer comprehensive courses designed to teach you everything you need to know about trading, including how to recognize the Evening Star pattern. Our courses don’t just stop at identifying patterns; we also focus on implementing effective trading strategies to help you succeed.

With expert faculty members who have extensive industry experience, you will receive high-quality instruction. Our hands-on training approach ensures that you gain practical knowledge that you can apply directly in the stock market.

Whether you’re a beginner or looking to enhance your trading skills, our programs are tailored to meet your needs. Join Stockers Academy today and start your journey toward mastering the Evening Star pattern and becoming a successful trader!

When trading the Evening Star pattern, it’s important to be aware of common mistakes that can lead to losses. Here are a few pitfalls to avoid:

1. Ignoring Confirmation

Always wait for the third candle to confirm the reversal before entering a trade. Jumping in too early can increase your risk. Make sure the bearish candle closes below the first candle to confirm that the trend is reversing.

2. Neglecting Stop-Loss

Failing to set a stop-loss can lead to unexpected losses. A stop-loss order protects your investment by automatically selling your position if the price moves against you. Always set a stop-loss above the high of the second or first candle to manage your risk effectively.

3. Overtrading

Avoid the temptation to trade every Evening Star you see. It’s important to wait for additional confirmation from other indicators before taking action. Patience is key in trading; waiting for solid confirmation can help you make better decisions.

At Stockers Academy, we teach our students how to avoid these common mistakes when trading the Evening Star pattern. By learning the right strategies and risk management techniques, you can improve your trading skills and increase your chances of success in the stock market.

Let’s consider a hypothetical example of an Evening Star trade to illustrate how this pattern works in practice:

Imagine you observe the Evening Star pattern forming on a daily chart for a popular stock. Here’s what you notice:

- First Candle: The first candle closes strongly bullish, showing that buyers have been in control and the price has been rising.

- Second Candle: The second candle shows indecision, closing near the previous day’s close. This small-bodied candle indicates that the momentum is slowing down, and the market is uncertain.

- Third Candle: The third candle closes significantly lower, confirming the reversal. This strong bearish candle signals that sellers have taken control and the price is likely to decline.

After observing this pattern, you decide to enter a short position after the third candle closes. To protect your investment, you place your stop-loss above the second candle’s high. As the stock price begins to decline, you monitor the situation and adjust your take-profit based on nearby support levels, ensuring that you secure profits as the price moves in your favor.

At Stockers Academy, we teach our students how to analyze such hypothetical scenarios to develop effective trading strategies for the Evening Star pattern. By practicing with real-world examples, you can become more confident in your trading decisions and enhance your overall trading skills

The Evening Star Candlestick Pattern is a valuable tool for traders seeking to enhance their technical analysis skills. By understanding how to identify and trade this pattern effectively, you can significantly improve your chances of making successful trades in the stock market.

At Stockers Academy, we provide the best stock market classroom coaching in Delhi, focusing on practical training and real-world application. Our expert faculty guides you through essential trading strategies, including the Evening Star, ensuring you gain the knowledge and confidence needed to navigate the markets.

Join us today to learn more about effective trading strategies and take your trading skills to the next level! Whether you’re a beginner or looking to sharpen your expertise, Stockers Academy is here to support your journey toward trading success.